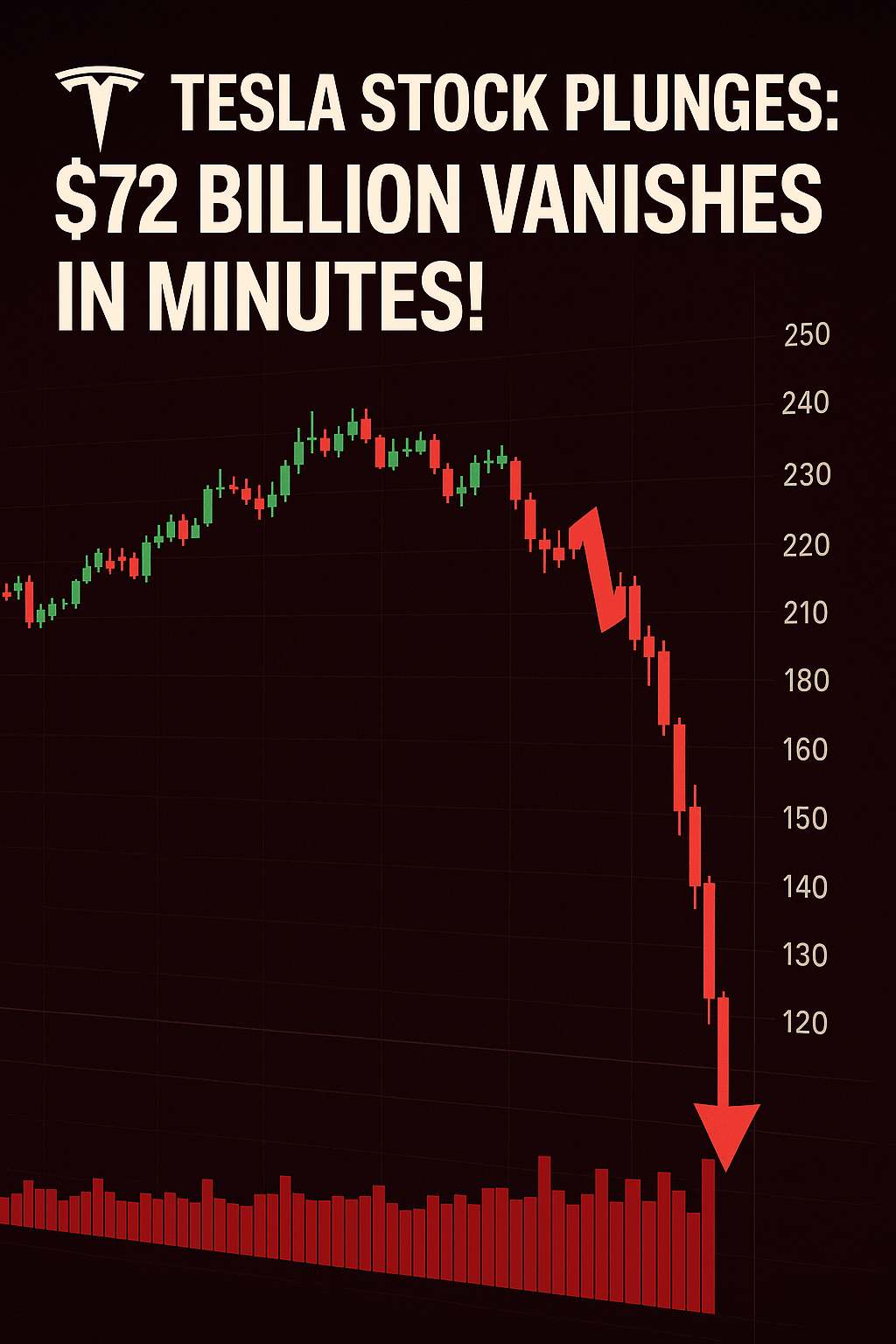

Investors woke up today to one of the most violent moves in Tesla’s trading history, as the EV giant’s stock collapsed more than 18% in under 9 minutes, sending shockwaves across global markets and vaporizing an estimated $72 billion in market value.

Analysts are calling it:

“The most chaotic Tesla candle of the decade.”

⚡ What Triggered the Collapse?

The sudden drop wasn’t caused by a single headline — it was a perfect storm:

An unverified leak suggested Tesla’s upcoming quarterly deliveries may fall short by nearly 14%. A major U.S. investment fund reportedly unloaded nearly $1.3B in TSLA shares in a high-frequency block sale. Meanwhile, options dealers were squeezed, forcing automated sell programs to cascade across the market.

Within seconds, Tesla’s chart turned into a waterfall.

📉 The Domino Effect

As Tesla’s price began to crater:

More than $2.1B in leveraged long positions were liquidated. The NASDAQ futures briefly dipped 1.7%. EV sector stocks like Rivian and Lucid got swept into the chaos. Short-seller volume surged to levels not seen since 2020.

Trading platforms reported delays and chart freezes, mirroring the panic from retail investors trying to exit positions.

🧨 Retail Traders Caught in the Crossfire

Thousands of retail accounts were margin-called before they even realized what had happened.

One trader wrote on X:

“By the time my screen refreshed, my stop-loss was useless. It was like watching a car crash in slow motion.”

🏭 Speculation Swirls Around Tesla

The Tesla community is buzzing with speculation:

Is there an undisclosed production issue? Was a major institutional player repositioning portfolios? Is this a pre-reaction to a global EV slow-down?

Some believe this may be nothing more than a liquidity shock amplified by algorithms, while others think a major announcement could be looming.

📈 The Rebound Attempt

Despite the crash, Tesla attempted a sharp rebound, climbing back above the $140 zone as bargain hunters and long-term believers jumped in.

But volatility remains extreme — with analysts warning the stock could swing another 10–15% either direction in the next 24 hours.

🌍 Global Markets On Edge

Tesla isn’t just a car company — it’s a market mover.

Its abrupt fall rattled Asia and Europe, with several EV-related ETFs plunging instantly.

Fund managers are watching closely.

🔮 What Happens Next?

Wall Street is waiting for an official statement, but until then, Tesla enters the market’s danger zone:

If the rumors are false, this could become the buying opportunity of the year. If they’re true, Tesla may be entering its most unstable chapter since 2018.

For now, one thing is certain:

The Tesla shockwave has hit — and the entire market is holding its breath.